schedule c tax form example

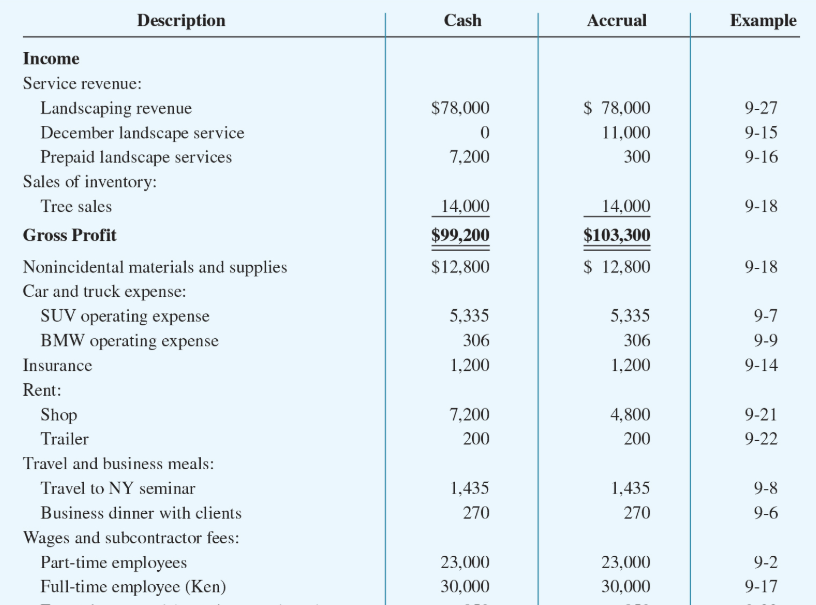

Below is a screenshot of a tax loss carryforward schedule built in Excel. Heres a quick example of what Part III might look like.

Business Activity Code For Taxes Fundsnet

Presently every Schedule C filer uses the.

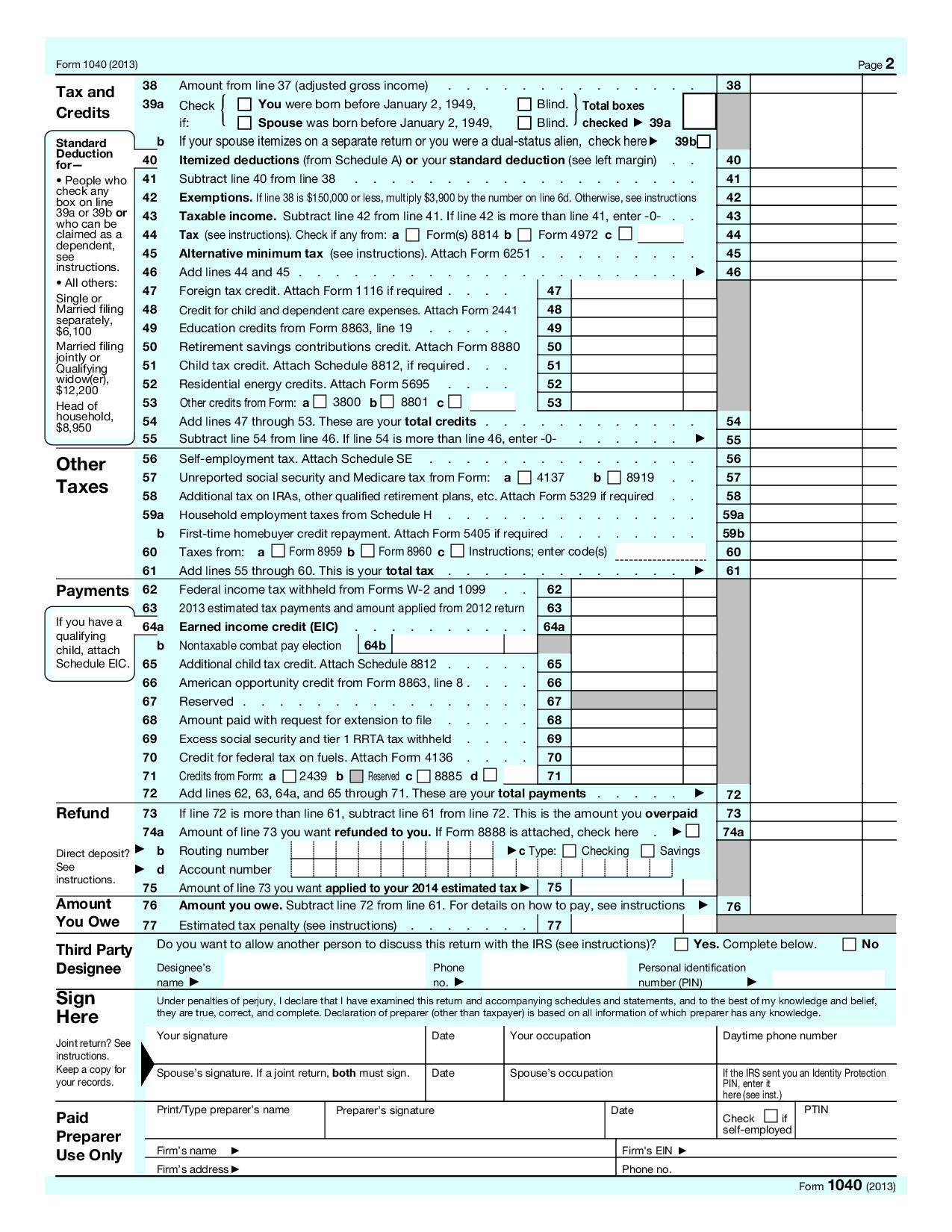

. Estates and trusts enter on. If a loss you. Follow the step-by-step instructions below to design your 2015 schedule c tax form.

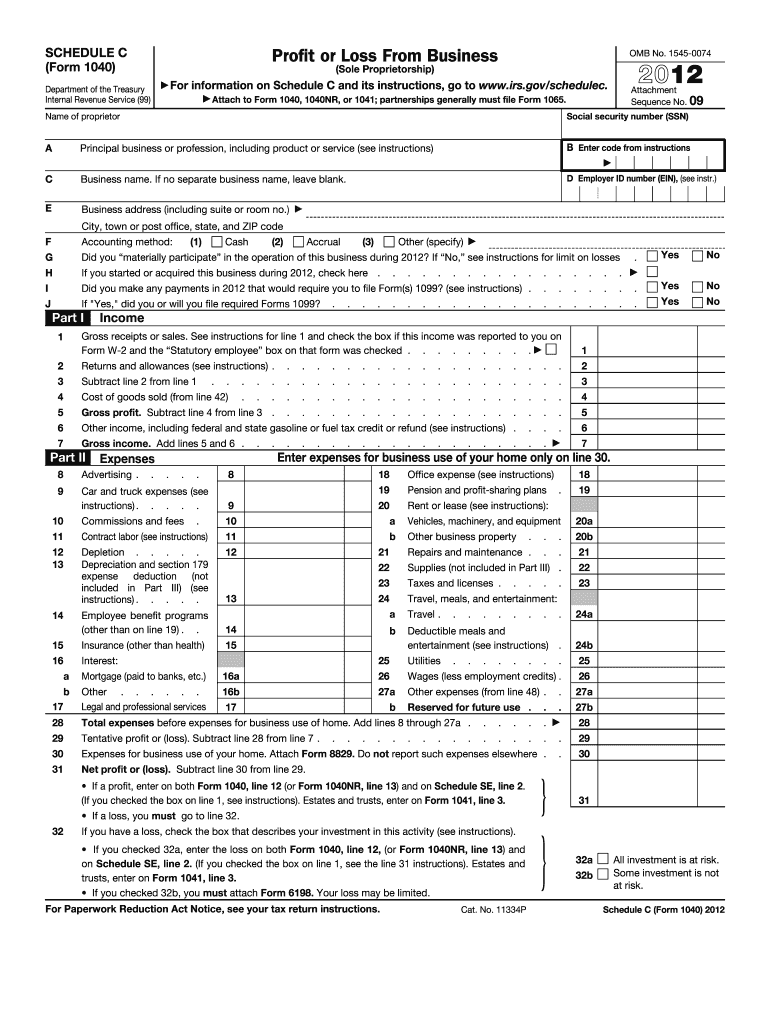

The IRS Schedule C form is the most common business income tax form for small business owners. The resulting profit or loss is typically. Decide on what kind of.

Were going to review this in detail below. All Revisions for Schedule C Form 1040 Sharing Economy Tax Center. Then select the activity that best identifies the principal source of your sales or receipts for example real estate agent.

This is taken from CFIs e-commercestartup financial modeling course. If you checked 32a enter the. About Publication 334 Tax Guide for Small Business For Individuals Who Use Schedule C or C-EZ About Publication.

Schedule 1 Form 1040 or 1040-SR line 3 or. See instructions for Line 1 and check the box if this income was reported to you on Form W-2 and the statutory employee box on. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible.

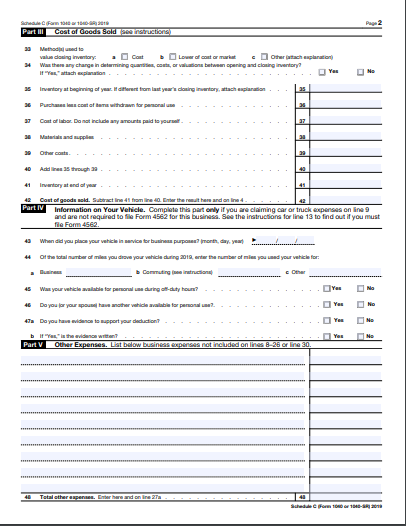

Go to line 32 31 32. Now find the six-digit code assigned to this activity for example. When filling out tax.

Frank Carter is a sole proprietor who owns and operates a fishing boat. Follow the step-by-step instructions below to design your 2015 schedule c tax form. Example Tax Loss Carryforward.

For 2019 and beyond. Schedule C-EZ was a simpler form of IRS Schedule C that some types of businesses used to use based on their income and expenses. The form is used as part of your personal tax return.

Form 1041 line 3. Form 1040 1040-SR or 1040-NR line 3a Qualified dividends -- 06-APR-2021. If you checked 32b.

The first is to help you. Businesses that file Schedule C are pass-through entities meaning they pay tax using their owners Form 1040. Form 1041 line 3.

Tax return schedules are tax forms you complete in addition to your return when you file. Name of proprietor. Schedule 1 Form 1040 line 3 and on.

If you have a loss check the box that describes your investment in this activity. Select the document you want to sign and click Upload. Say you sell vintage.

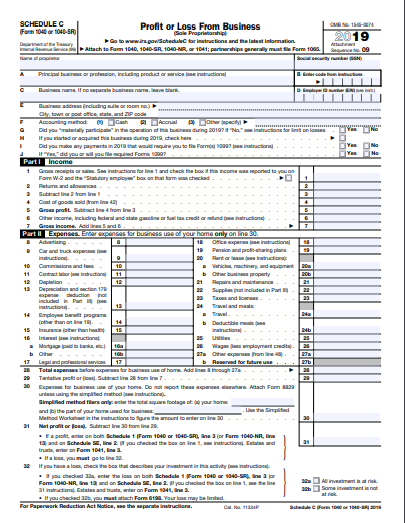

Gross receipts or sales. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. He uses the cash method of accounting and files his return on a calendar year basis.

The format followed is defined and. Schedule C is an IRS form that self-employed people use to report profit or loss from their business. These forms essentially serve two purposes.

The first section of the Schedule C is reserved for your business information. Up your record keeping to reflect each line on Schedule C Form 1040. Estates and trusts enter on.

Schedule SE line 2. Form 1040-NR line 13 and on. The Schedule C tax form.

If you checked the box on line 1 see the line 31 instructions. This form can be used by an organization to calculate its profit and losses in accordance with the tax laws and then submit these to the taxation department. As a sole proprietor money isnt taxed differently whether in your.

If you checked the box on line 1 see the line 31 instructions. Schedule SE line 2.

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

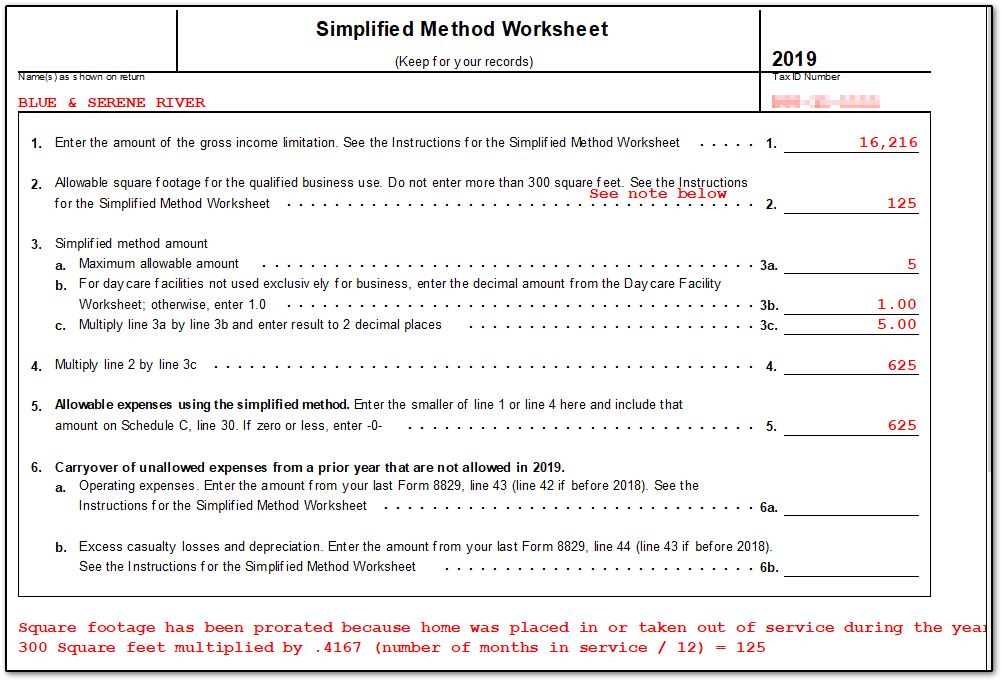

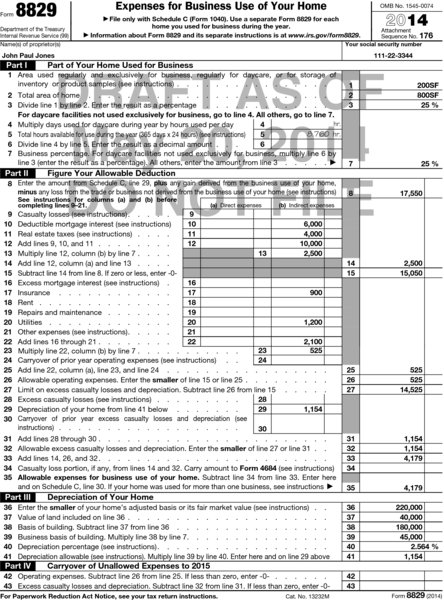

Publication 587 Business Use Of Your Home Schedule C Example

1040 U S Individual Income Tax Return With Schedule C

Schedule C Pdf Schedule C Form 1040 Profit Or Loss From Business Omb No 1545 0074 2017 Sole Proprietorship To Www Irs Gov Schedulec For Course Hero

Tax Preparing Guide For Photographers Intrepid Freelancer Photographer Blog

What Is Schedule C Tax Form Form 1040

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

5 Printable Schedule C 1040 Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Schedule C Pdf Fill Online Printable Fillable Blank Pdffiller

Irs Crypto Tax Forms 1040 8949 Koinly

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

8829 Simplified Method Schedulec Schedulef

Self Employment Income How To File Schedule C

How To Fill Out Your 2021 Schedule C With Example

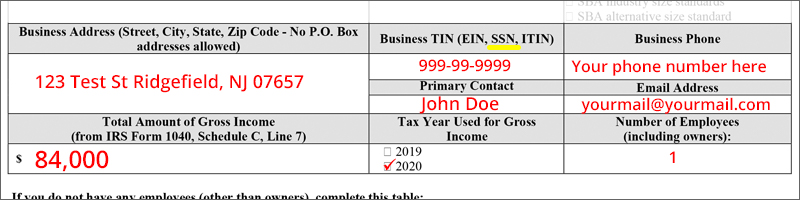

New Self Employment Gross Income Ppp Loan Application Guide

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting